Ebitda margin formula

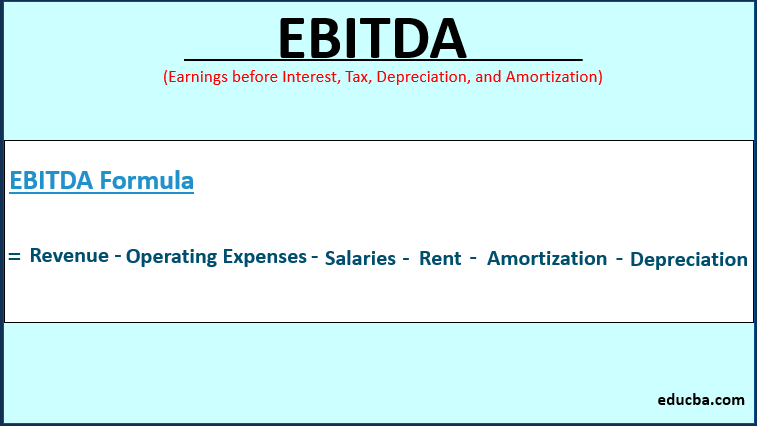

EBITDA net income interest expenses tax depreciation amortization. The EBITDA margin is usually a percentage found using the.

What Is An Ebitda Margin Examples And How To Calculate Thestreet

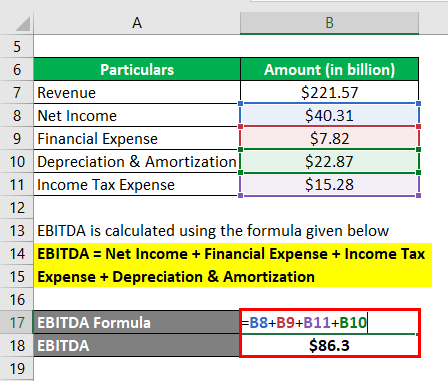

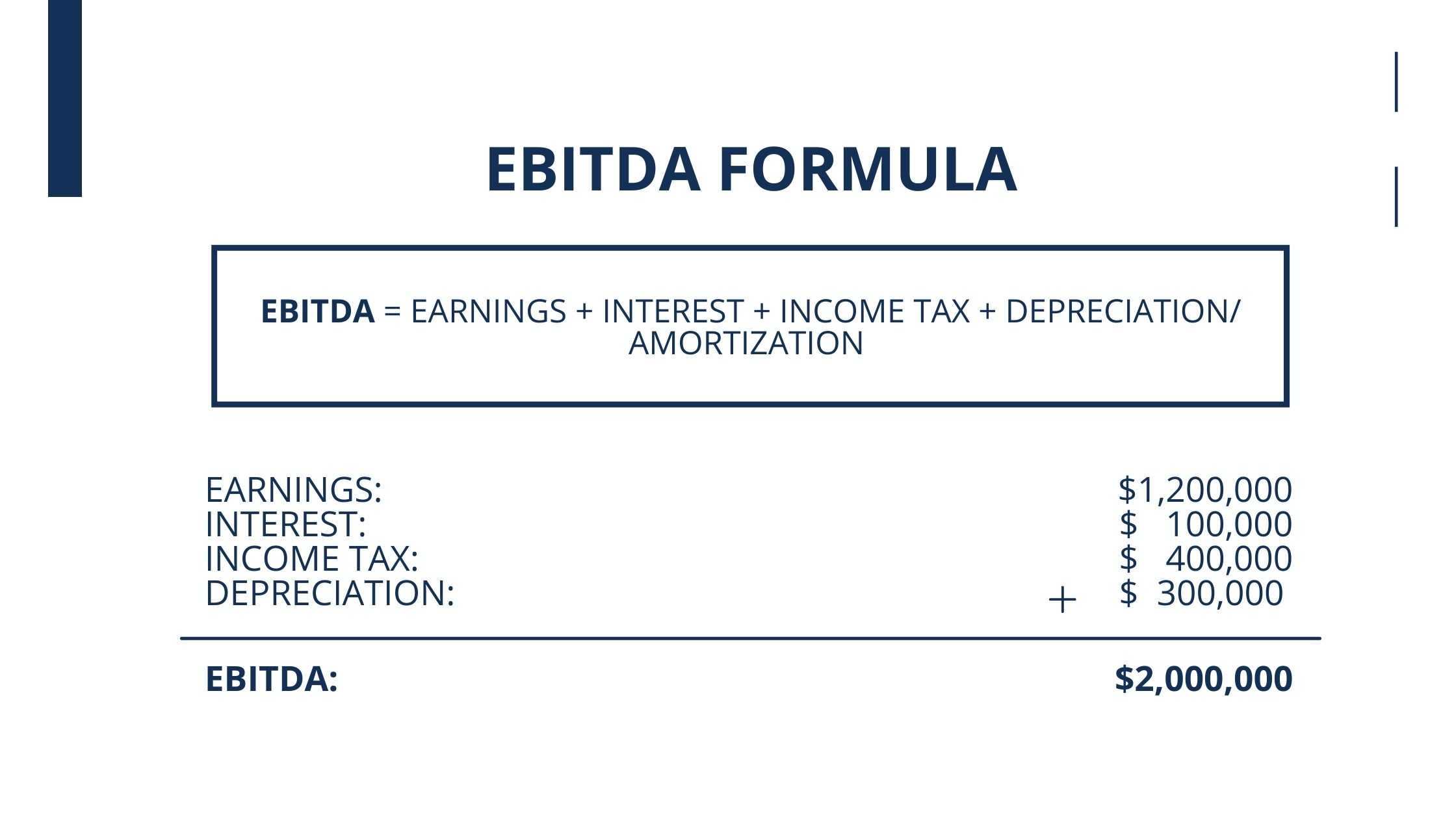

EBITDA Net Income Taxes Interest Expense Depreciation Amortization Unlike the first formula which uses operating income the second formula starts with net.

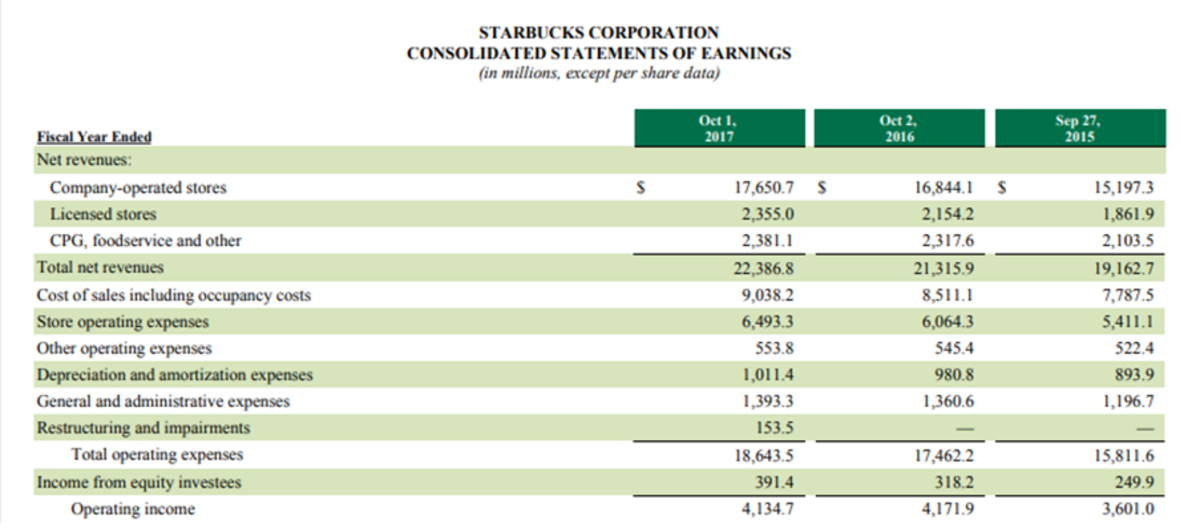

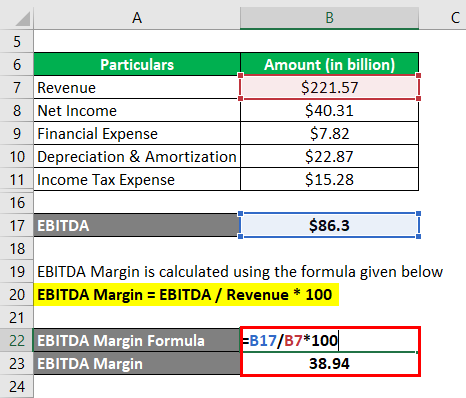

. For instance suppose a company has generated the following results in a given period. EBITDA 150000 9000 17000 4000 6000. What this means is that Walmart.

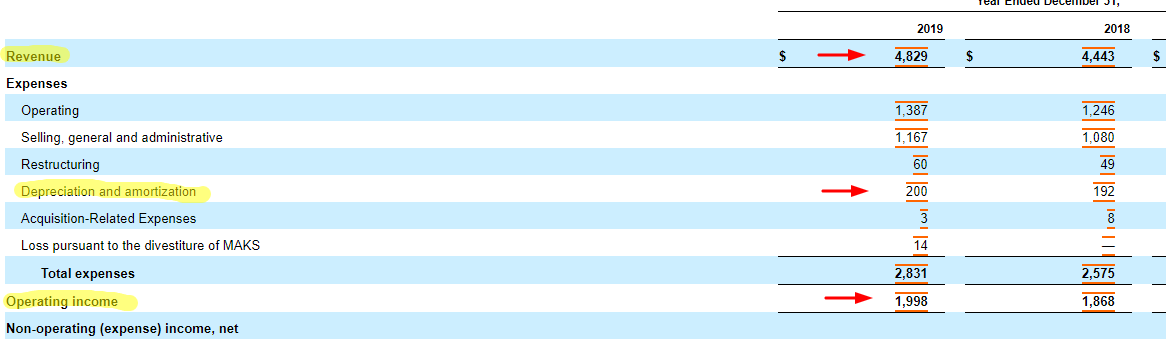

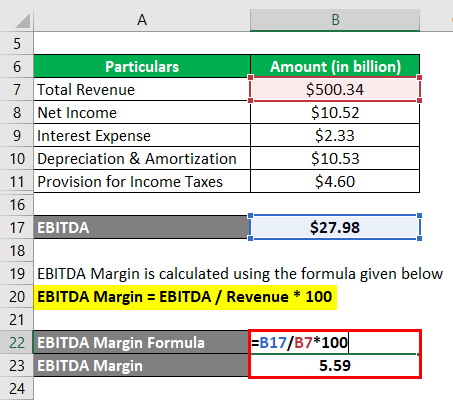

Second after obtaining the EBITDA we compare it to revenue to obtain a margin figure expressed as a percentage. StockEdge gives us EBITDA of the last five years of any company listed in the. Ad Invest globally in stocks options futures currencies bonds funds from one screen.

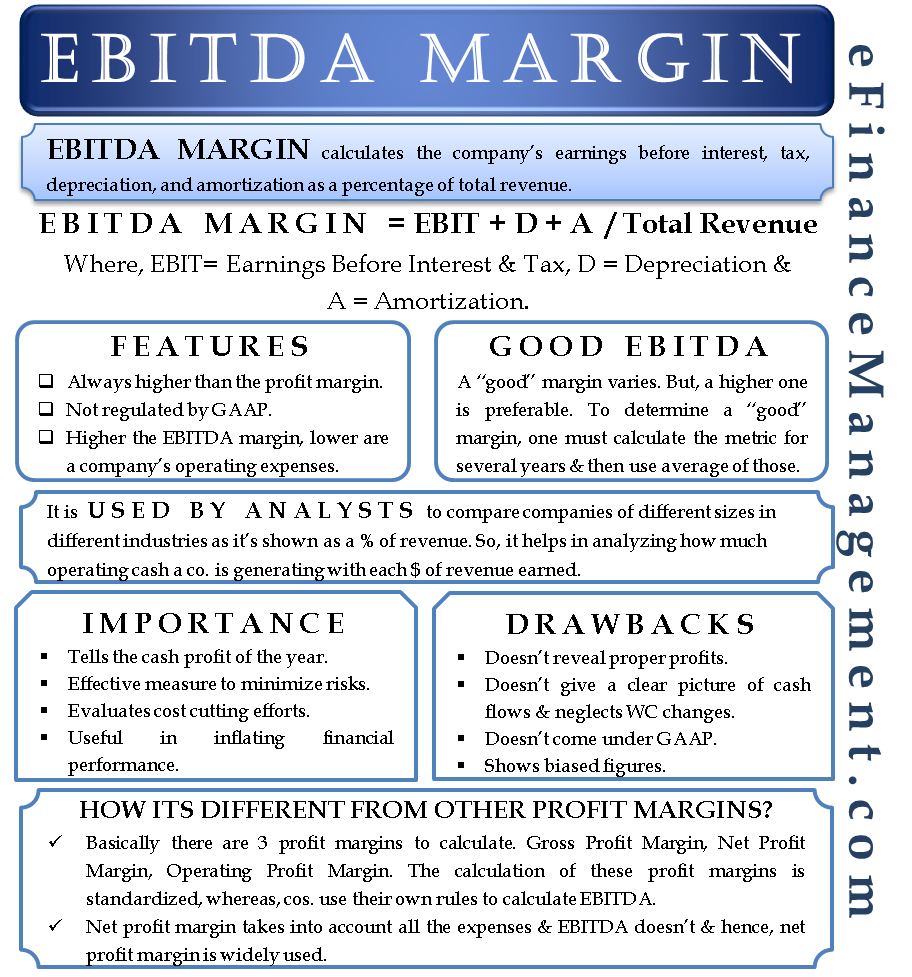

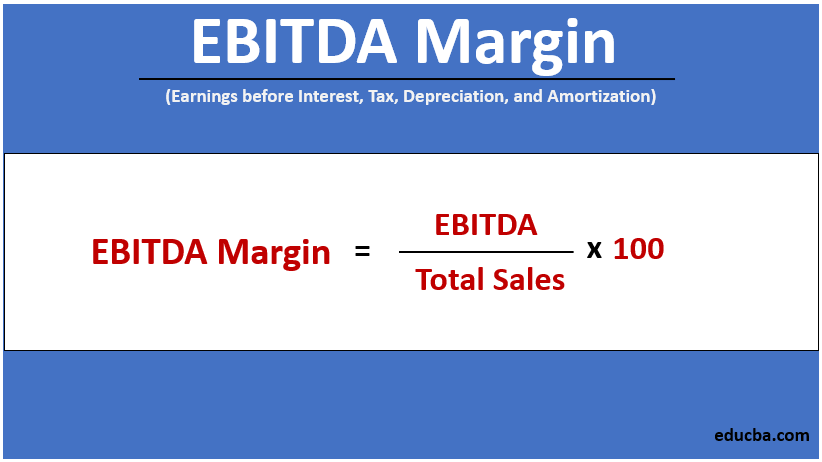

EBITDA Margin EBITDA Revenue. The formula for EBITDA margin is expressed as a summation of net income interest tax and depreciation amortization DA expense divided by total sales. What is a good EBITDA margin.

EBITDA margin EBITDA Net Sales 31555 523964 60 As evident from the calculation above Walmart earns a moderate EBITDA margin of only 6. But instead of calculating your total revenue that resulted in net profit it shows how much of your total revenue resulted in EBITDA. Cost of Goods Sold.

For each dollar of revenue generated what percentage of it trickles down to EBITDA The ratio. EBITDA Margin is calculated using the formula given below. EBITDA Margin EBITDA Revenue.

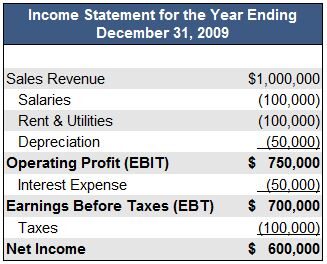

EBITDA margin 550 10. EBITDA margin EBITDA Sales revenue The margin doesnt include the impact of a companys capital structure non-cash expenses or income taxes. How to calculate EBITDA margin.

EBITDA margin earnings before interest and tax depreciation amortization total revenue That makes it easy to compare the relative profitability of two or more. EBITDA Margin EBITDA Revenue 100. The EBITDA formula is.

EBITDA is earnings before interest taxes depreciation and amortization. EBITDA margin calculation example. EBITDA margin 1800000 900000 10000000 27 Although both companies have same.

Here is the formula. EBITDA Margin EBITDA Revenue. Nowadays we dont have to calculate EBITDA on our own.

EBITDA margin EBITDA Sales. An EBITDA margin is similar to profit margin. The margin is calculated as follows.

EBITDA margin 1800000 200000 10000000 20 Company B. EBITDA Net Income Interest Taxes Depreciation Amortization Expenses. The most common way to calculate your EBITDA margin is by starting with your net income and then adding back in the figures for any interest youre.

Most companies do not include a gain on sale as revenue if the gain is a non-operating income. The EBITDA margin is EBITDA divided by revenue. Interactive Brokers clients from 200 countries and territories invest globally.

The EBITDA margin answers the following question.

Your Ebitda Margin Guide How To Use The Controversy Real Examples

Ebitda Margin Definition Example Investinganswers

Ebitda Types And Components Examples And Advantages Of Ebitda

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

Ebitda Margin Formula Meaning Interpretation With Examples

Ebitda Margin Template Download Free Excel Template

Ebitda Margin Formula Meaning Interpretation With Examples

Ebitda Margin Features Importance Drawbacks Other Profit Margins

Ebitda Margins What Every Small Company Owner Needs To Know

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

Ebitda Margin Formula And Calculator Excel Template

How Do I Calculate An Ebitda Margin Using Excel

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

What Is Ebitda Formula Example Margin Calculation Explanation

Ebitda Margin Formula And Calculator Excel Template

How To Calculate Ebitda Margin

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin